unrealized capital gains tax janet

The Market Risk Premium RPM 384 Using the CAPM to Estimate the Cost of Common Stock. How Effective Is the Effective Corporate Tax Rate.

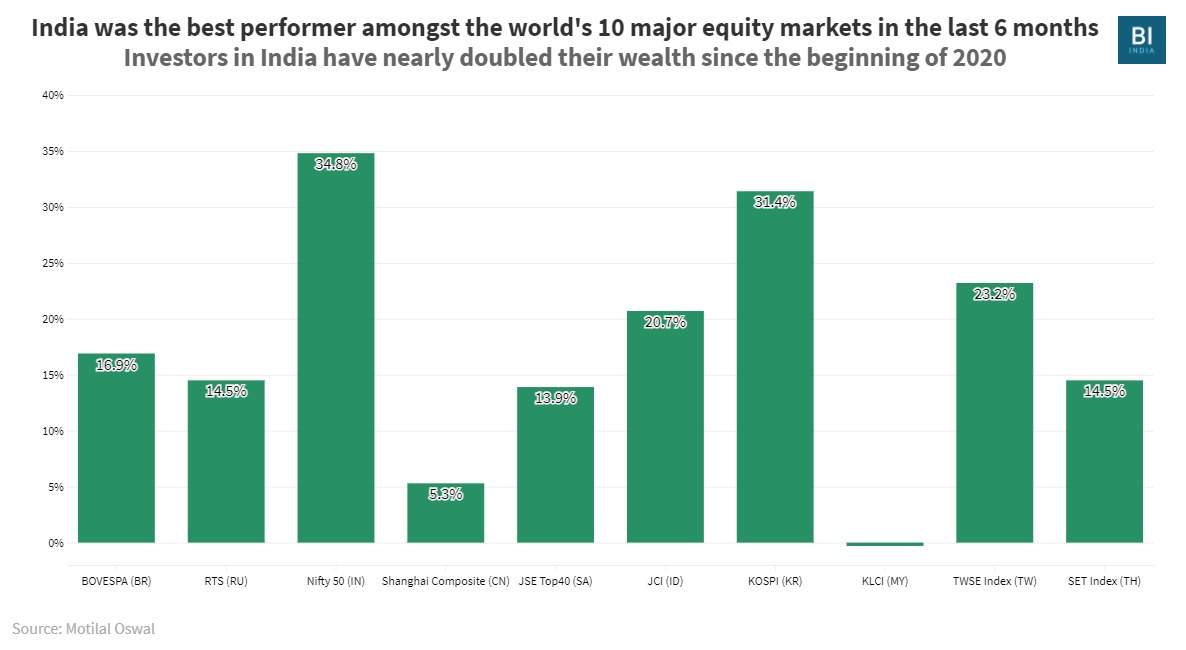

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

If you need professional help with completing any kind of homework Solution Essays is the right place to get it.

. Cost of Common Stock. Cheap essay writing sercice. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Ordering tax forms instructions and publications. The maximum tax rate on qualified dividend income is the same as the capital gains rate and is substantially lower than the maximum rate on ordinary income. Attributable capital.

Schedule D Form 1040 Capital Gains and Losses. The great thing about being in the 15 tax bracket is that dividends and long-term capital gains get taxed at 0. The Weighted Average Cost of Capital 376 Choosing Weights for the Weighted Average Cost of Capital 378 After-Tax Cost of Debt.

We always make sure that writers follow all your instructions precisely. 30K investment income long-term capital gains and dividends So the total income would be 39K and after the standard deductions and exemptions the taxable income would be 29K. The loss recognized in Year 2 will be treated as 60 long-term capital loss and 40 short-term capital loss.

1099-A Acquisition or Abandonment of Secured Property. All gains and losses occurring after the section 1092b2 identified mixed straddle is established are accounted for under the applicable provisions in 11092b3T. Whether you are looking for essay coursework research or term paper help or with any other assignments it is no problem for us.

The maximum tax rate on the long-term capital gains of domestic non-corporate taxpayers is 20. This would put the lab rat in the 15 tax bracket. Capital losses that exceed capital gains in a year may be used to offset ordinary taxable income up to 3000 in any one tax year.

Net capital losses in excess of 3000 can be carried forward. On September 3 Year 1 A enters. 1 BUSINESS STRUCTURES AND QUALIFICATIONS 11 BUSINESS STRUCTURES 111 Members.

07 million and 161 million 2215. High school collegeuniversity masters or pHD and we will assign you a writer who can satisfactorily meet your professors expectations. Net unrealized appreciation in employers securities.

Congress is debating new ways to raise revenue that would make the tax code more complex and more difficult to administer. Cost of Preferred Stock rps 384. Portion of the distribution allocated to capital gains.

You can choose your academic level. Federal income tax withheld from the distribution if any Box 5. The exclusion of such unrealized mark-to-market gains and losses from the presentation of this performance measure enables investors to understand performance based on the.

A distribution code designed to specify the type of. Get 247 customer support help when you place a homework help service order with us. A method of crystallizing capital losses by selling losing positions and purchasing companies within similar industries that have similar fundamentals.

1099-C Cancellation of Debt. Portion of the distribution allocated to employee contributions designated Roth contributions or insurance premiums. Rd 1 T and rstd 1 T 379.

ALL YOUR PAPER NEEDS COVERED 247. Forward-looking information or forward-looking statements have been included in this Annual Report on Form 10-K to provide information about us and our subsidiaries and affiliates including managements assessment of our and our subsidiaries future plans. The latest proposal reflects the reality that moderate Democrats are unwilling to back certain ideas aimed at raising money including taxing the unrealized capital gains of billionaires and.

Academiaedu is a platform for academics to share research papers. 11 Alternative Minimum Tax Exemption for a. Individual Income Tax Return.

No Member or Approved Person as defined in By-law 11 in respect of a Member shall directly or indirectly engage in any securities related business as defined in By-law 11 except in accordance with the following. Actuarial losses gains that will not be reclassified to profit or loss Net of tax of 12 million and 246 million. Individual Income Tax Return.

Because as a REIT we are not generally subject to tax on the portion of our REIT. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Get 247 customer support help when you place a homework help service order with us.

No matter what kind of academic paper you need it is simple and affordable to place your order with Achiever Essays. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The new proposalsimposing an alternative minimum tax on corporate book income applying an excise tax on stock buybacks and at one point this week a tax on unrealized capital gains for billionairesare unreliable and highly complex ways.

8949 Sales and Other. Security Analysis Portfolio Management Book by Reilly Brown. At May 31 2021 the cost of investments net unrealized appreciation depreciation and undistributed ordinary income and undistributed long term capital gains for income tax purposes were as.

Enter the email address you signed up with and well email you a reset link. The aggregate of the net unrealized appreciation of portfolio securities and net realized gains on sale of securities is 156998295 of which 152588482 represents net unrealized appreciation. 4797 Sales of Business Property.

All amounts are provided on a before tax basis unless otherwise stated.

Mr Whale Cryptowhale Us Treasury Secretary Janet Yellen Suggests Imposing A Tax On Unrealized Capital Gains This Means Stock Gains Will Be Taxed Even When They Have Not Been Sold It Also Means That Taxes Will Be Owed When The Value Of A Home

Key Points Taxing Unrealized Capital Gains Is Not Practical And Will Hurt Sentiment Among Investors Said

Why The Fed Needs Janet Yellen To Steal W Unrealized Capital Gains Avoiding Taxes W Roth Iras Youtube

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Janet Yellen S Idea To Tax Steal Unrealized Capital Gains Spike Cohen Calls It An Act Of War Against The Middle Class R Libertarian

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Uzivatel Bloombergquint Na Twitteru Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points

Janet Yellen Proposes Insane Capital Gains Tax On Bitcoin Youtube

Tax On Unrealized Gains How Long Before It Hits Every Investor By Rick Mulvey Coinmonks Medium

Janet Yellen May Give Us Bitcoin Investors Tax Shock Somag News

Janet Yellen It S Not A Wealth Tax It S A Tax On Unrealized Capital Gains Bit Haw

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

Tax On Unrealized Capital Gains Proposal By Janet Yellen Exponential Age Youtube

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Therapist Are The Unrealized Capital Gains In The Room With Us Now Janet R Bitcoin